Calculating Sales Tax Worksheet. These are the commissions organized in our worksheet on this case. Was it one hundred of the February shares and 50 of the January shares, or did they sell 75 shares from each lot? These holidays normally exist to offer further savings that encourage consumers to make purchases for back-to-school purchasing or hurricane preparedness throughout a particular time. It may be very tax efficient as not solely are your tax and national insurance coverage liabilities lowered, but employers nationwide insurance coverage can also be lowered.

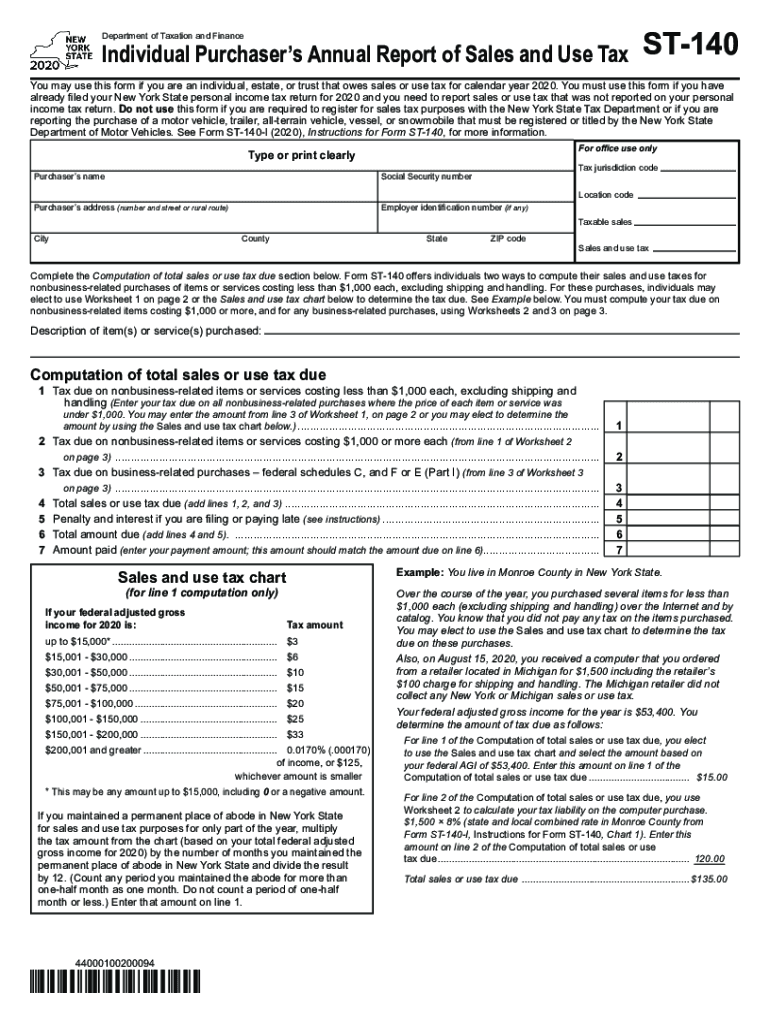

By providing the data below, the Comptroller’s workplace provides technical help and never legal advice. Taxing units ought to seek the advice of authorized counsel for interpretations of regulation regarding tax rate calculations.

SpreadsheetConverter can take nearly any spreadsheet with formulation and all, and convert it to a reside web web page that also does all of the calculations exactly the same as in Excel. SpreadsheetConverter also includes the instruments required to publish the transformed calculator on the net.

Unlock Your Education

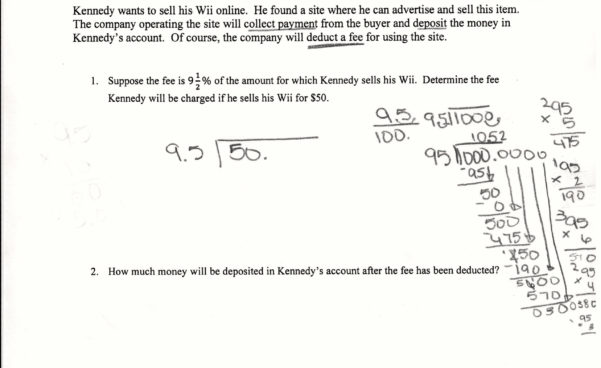

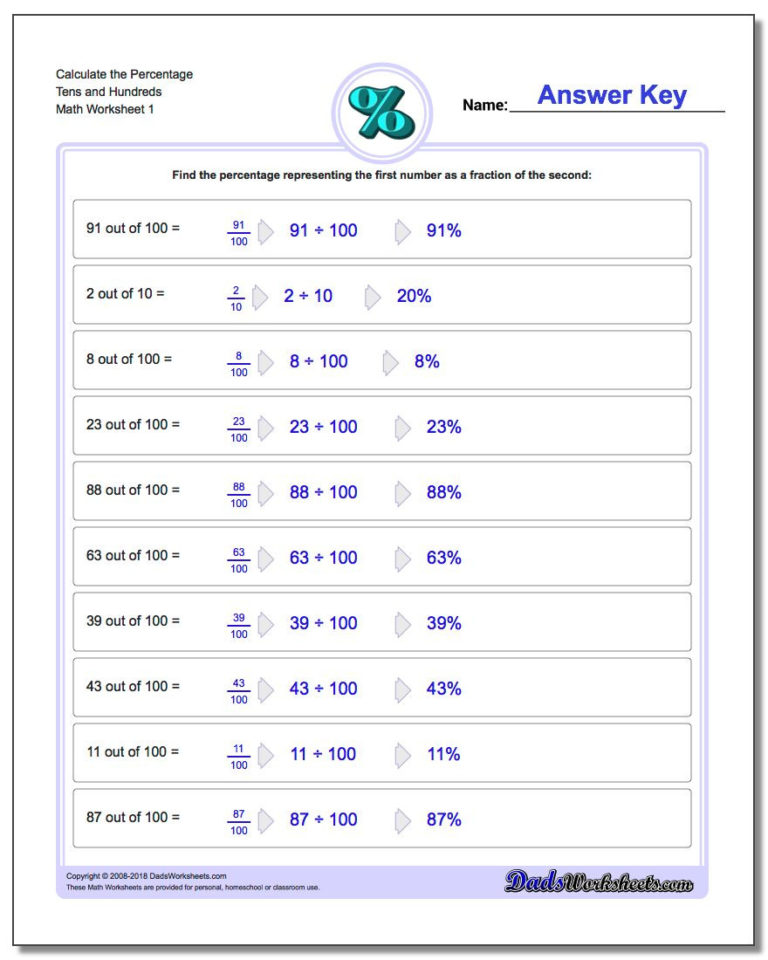

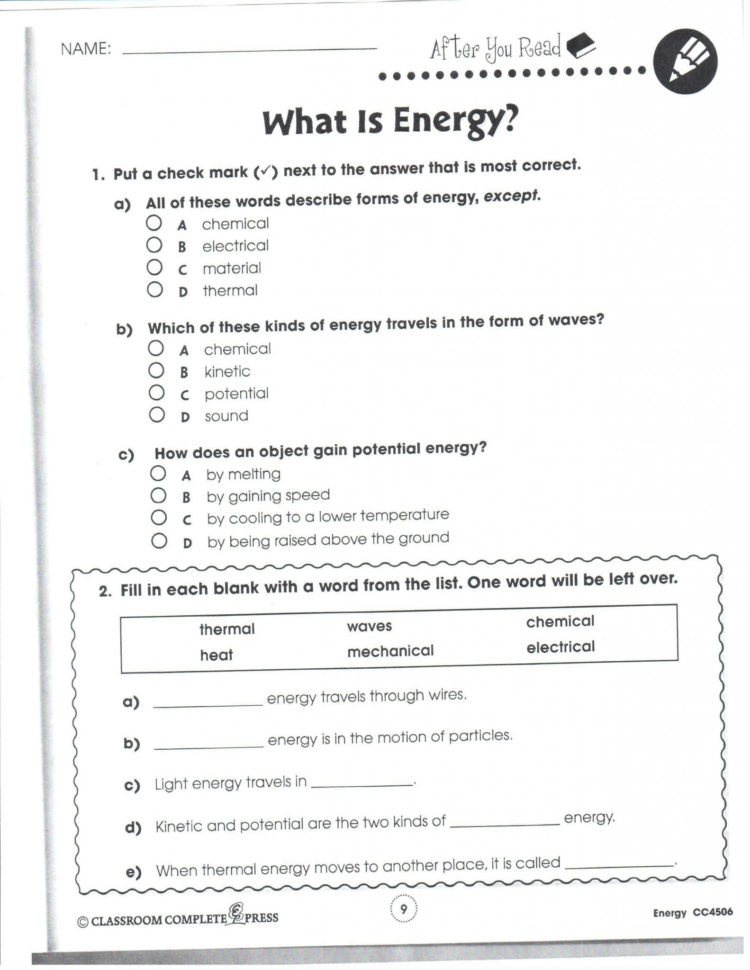

Complete the sales receipts in these pdf sales tax worksheets by filling the acquisition costs, given the sales tax fee, unique costs, and the quantity. Fill within the whole amount after including the gross sales tax of every item. Are you in search of a enjoyable and practical project to use in your financial literacy unit?

For a tax allowance, please enter a optimistic figure such as one thousand (for a £1,000 allowance). For a tax deduction, please enter a unfavorable number similar to (for a £1,000 deduction).

Calculating Gross Sales Tax Worksheet: Fill & Obtain For Free

Your earnings tax return or refund arises if the tax payable is less than the taxes already paid through the tax 12 months. Usually for a salaried taxpayer a refund arises if either the deductions usually are not taken under consideration or he/ she earns a lower revenue than estimated revenue.

three See Publication 4012, Page D-1, Table B for extra examples of non-taxable income. It is an indirect gross sales tax applied to sure items and companies at multiple instances in a provide chain. Taxations across multiple international locations that impose either a “GST” or “VAT” are so vastly totally different that neither word can correctly define them.

Capital Features Tax Calculation Worksheet

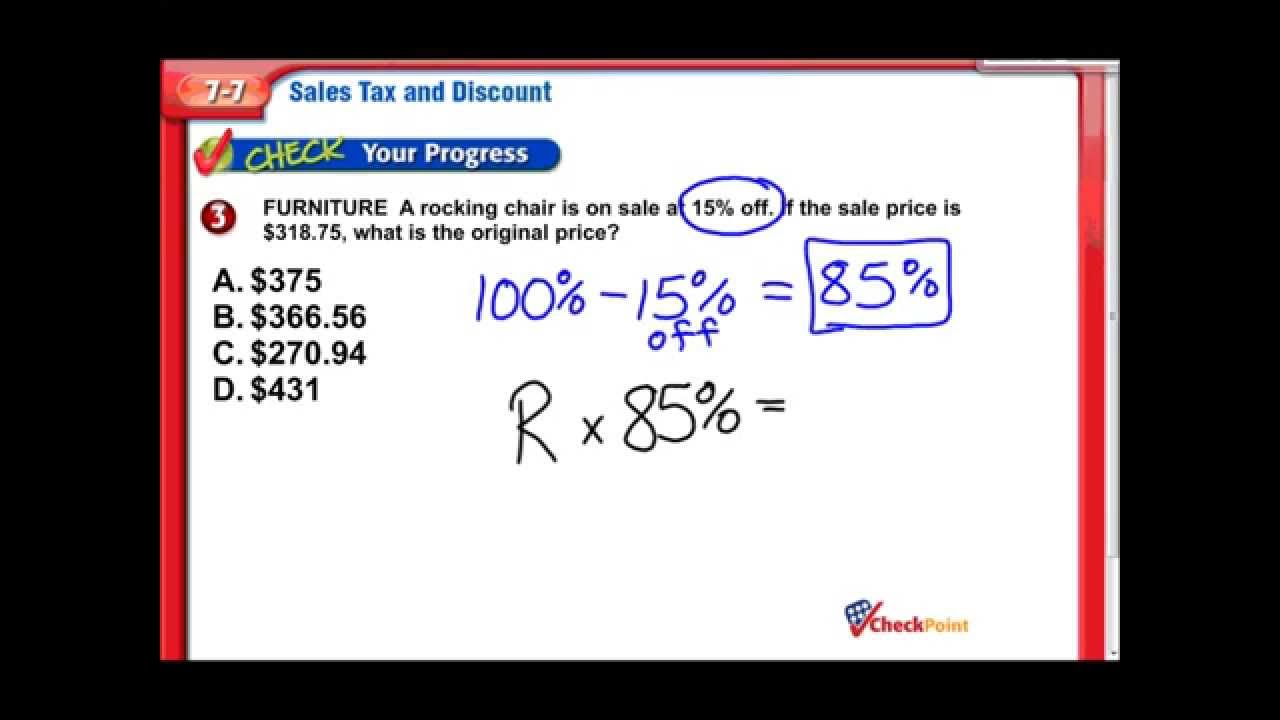

Find the discount quantity, marked worth, or sale worth by utilizing the appropriate formulation. As we know, we all the time pay the sales tax when shopping besides buying duty-free goods.

The online earnings tax calculator is a handy device and is free to use. It is straightforward to grasp and can be used by anyone to calculate their tax liability. Students use Excel spreadsheets to arrange purchases, reductions, sales prices, and gross sales tax.

Some of the sooner attempts at gross sales tax raised a lot of problems. Sales tax did not take off till the Great Depression, when state governments had been having difficulty finding methods to lift revenue efficiently. Of the numerous totally different strategies examined, gross sales tax prevailed as a outcome of financial coverage in the 1930s centered around selling items.

You create your formula-driven web page immediately in Excel, with the talents you have already got. The ensuing net page may be simple, but very promising. Sales Tax States, to calculate gross sales tax of US States, city and zip code.

Here, the 6th grade and seventh grade college students subtract the model new value from the unique value to acquire the price reduction. To practice Math expertise, there is nothing simpler than fixing worksheets. Our free to download, printable worksheets assist you to practice Math ideas, and improve your analytical and problem-solving skills.

An revenue tax calculator is a device that can help calculate taxes one is liable to pay under the old and new tax regimes. The calculator uses necessary basic information like annual salary, lease paid, tuition charges, curiosity on child’s schooling mortgage, and any other savings to calculate the tax liability of a person.

There is not any need to assert any tax reliefs as these are offered at supply. PENSION CONTRIBUTIONS – If you frequently contribute into a pension plan, please enter the quantity and frequency by which, payments are made for. The calculator will automatically adjust and calculate any pension tax reliefs relevant.

Deduct the exemptions, allowances, and deduction from the gross revenue. This shall be your web taxable income for the monetary year.

There are two conditions to calculate the gross sales tax in Excel. The last year’s gross sales tax revenue is the amount from the primary full year of sales tax revenue spent for M&O.seventy nine This adjustment is necessary to properly account for gross sales tax revenue obtained in the previous 12 months. If this part were not added, the gross sales tax adjustment would not properly mirror the change in gross sales tax revenue from one yr to the next.

The revenue tax in your month-to-month salary will be tax payable for the 12 months divided by 12 months. If you’ve joined in the course of the monetary yr the monthly tax shall be tax payable divided by the variety of months remaining for the 12 months.

Displaying all worksheets associated to – Calculating Sales Tax.

Begin by figuring out whether or not or not there is a state gross sales tax in the state your business is in. Then, decide whether or not or not the town or county has a sales tax rate and what the rate is. In the US and the District of Columbia all states besides Alaska, Delaware, Montana, New Hampshire and Oregon impose a state gross sales tax if you buy items or pay for companies.

CHILDCARE VOUCHERS – The childcare voucher choice is applicable solely to schemes which have been entered into post April sixth 2011. Enter the quantity you could have sacrificed from your salary month-to-month to purchase vouchers.

This resource immediately helps Ontario’s new grade 5 math curriculum. Section four of the Comptroller’s Tax Rate Calculation Worksheet supplies data needed for calculating the additional tax price to add to the voter-approval tax rate.

This, together with different occasions, led to the American Revolution. Therefore, the start of the us had partly to do with the controversy over a sales tax! Since then, sales tax has had a rocky history in the us and that is perhaps why there has by no means been a federal gross sales tax.

Limited doesn’t accept any liability for any loss or damage suffered as a consequence of relying on any info contained in this information. Members who submit a tax return utilizing the SimpleTax calculator. It will also obtain a referral charge for any user that pays the £49.99 fee to submit a tax return using the calculator.

Teenagers love to consider driving and shopping for their first automobile. The intent of this resource is to create an equation for the list value of a car and add the suitable state tax. Once your teens perceive the calculation, ask them to…

A reimbursement of interest on home loan up to Rs 2 lakh for a self-occupied property. There isn’t any upper limit on curiosity on a home loan if you let loose the home property. Income From House Property– Add your net rental income for a let-out property to your gross income.

Calcul Conversion can not be held answerable for issues related to using the data or calculators offered on this website. All content on this site is the exclusive mental property of Calculation Conversion.

Since the end-user of a taxable good or service pays the sales tax, people who purchase items and intend to resell the product to the end-user are exempt from paying the sales tax. The reseller often wants a resale certificates that proves their exemption to the companies they’re purchasing the products from. The reseller then becomes responsible for amassing the gross sales tax from the end-user with the ultimate sale of the product and passing it on to their state and local authorities.

The original buy worth of the tv is $250.00, which is one hundred pc of the acquisition worth. Adding the 6% sales tax price to this, the entire price is 106% of the acquisition value.

Solutions do not present how to multiply by the decimal, but method could be added in. In this gross sales tax lesson, college students work in groups to spend $500.

Income tax, property tax, estate tax, and import tax are some frequent methods of taxation. One tax that just about everyone encounters incessantly is the gross sales tax. When a services or products is bought by a consumer, a gross sales tax is usually applied to the purchase price that the patron pays to the service provider.

All tax calculation made by this calculator are primarily based upon annual taxation rates and allowances, so any figures provided with be annualised. In the tax yr after the top of the catastrophe calculation time period, the taxing unit should calculate its emergency income fee and cut back its voter-approval tax fee for that yr.