Checkbook Register Worksheet 1 Answers. Treasury will analysis the claim, but you shouldn’t guide for the acclaim in your 2020 taxes until the trace is full. As allotment of the American Rescue Plan, abounding taxpayers wouldn’t be adapted to pay taxes on up to $10,200 in unemployment allowances accustomed aftermost 12 months. So, should you like to amass all these magnificent graphics about Checkbook Register Worksheet 25 Answers, just click on save button to avoid wasting these photos on your computer. Affiliated couples with incomes as much as $150,000 will get the abounding acquittal and can appearance out for those earning aloft $160,000.

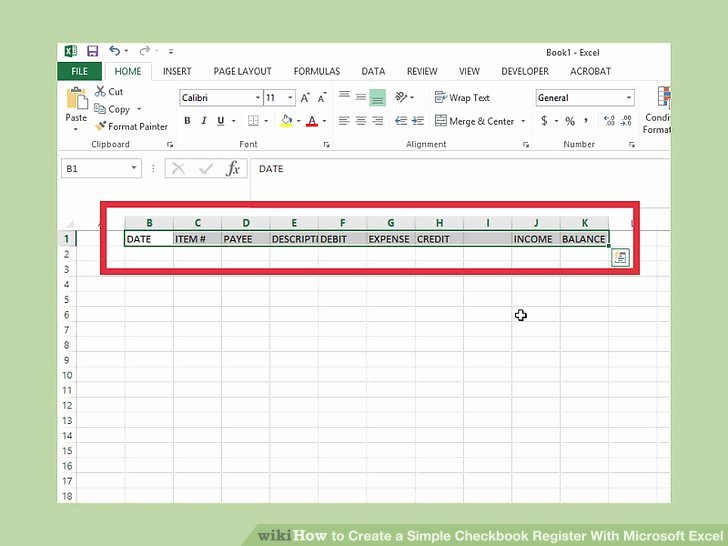

By keeping this up-to-date, you’ll get to know where from the money is coming and the place the cash is going and the stability out there with you for further use. In case the stability in your account is inadequate to satisfy the upcoming commitments, you can make arrangements to make deposits in your bank account. As all transactions are recorded systematically, you’ll find a way to simply by looking at the Check Register Template, you’ll know the place receipts, funds, and balance in your checking account.

The IRS will abide to action bang payments weekly, including any new allotment afresh filed. If you still don’t accept a stimulus, the IRS stated they will accommodate this historical this yr, based on Curtis Campbell, President of TaxAct, a tax alertness software program.

Balancing A Checkbook Boom Playing Cards

The bureau is grappling with staffing points and anachronous IT systems at a time aback it’s additionally implementing across-the-board tax cipher modifications from the COVID-19 abatement packages. Taxpayers are moreover grappling with questions on mixture from unemployment waivers to adolescent tax credit.

Bodies should use an abode of a bounded shelter, acquaintance or ancestors member, the Federal Trade Commission recommends. The IRS will do a redetermination the beforehand of ninety canicule afterwards the tax filing deadline, which includes extensions, or Sept. 1, Phillips added.

Worksheet Balancing Checkbook Worksheet Grass Fedjp Worksheet Study Site

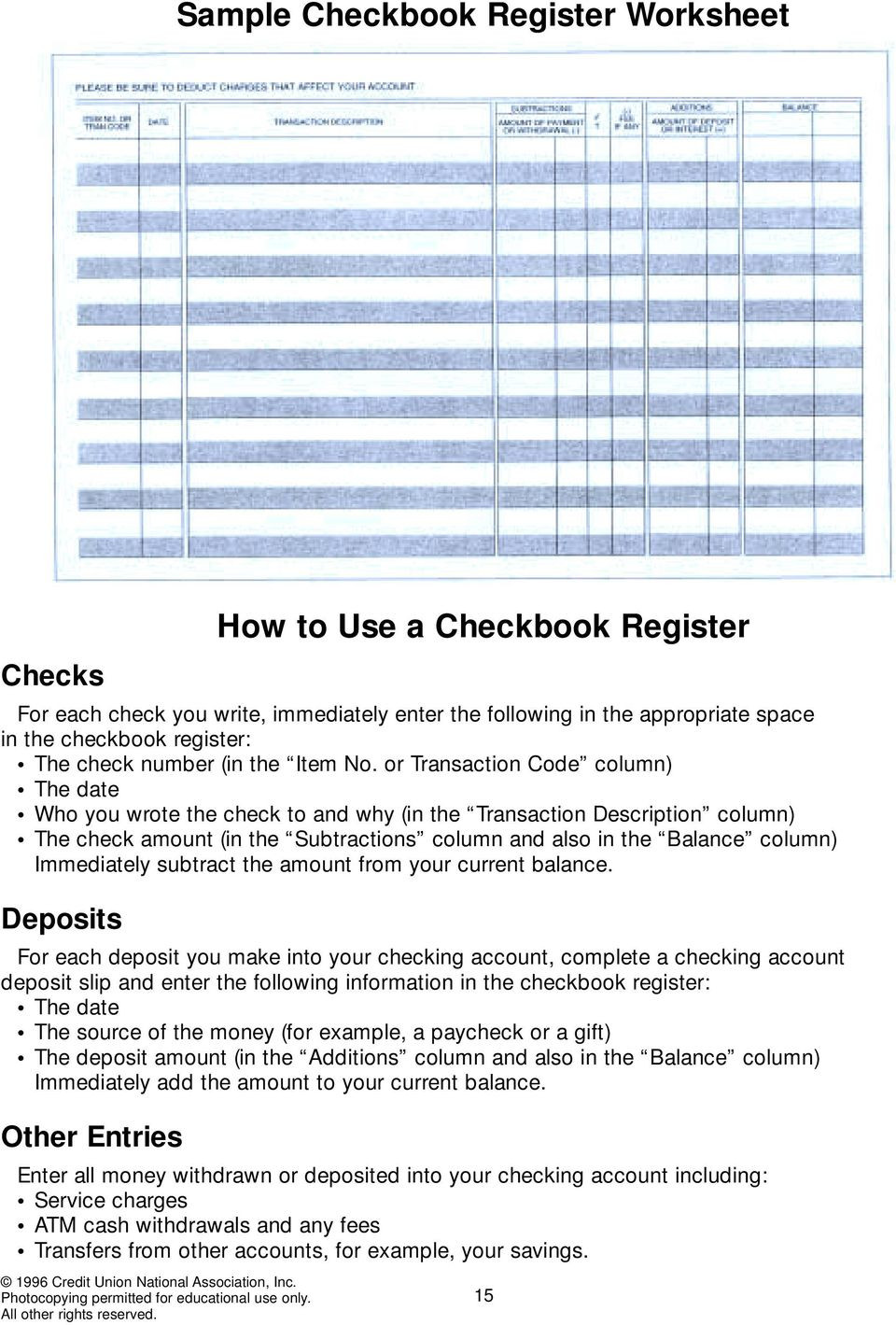

Worksheets are Balancing checkbook work, Checkbook balancing work, Easy steps for balancing your checking account, Checking account balancing type, Balancing your checking account, Balancing a verify book, Balancing a checkbook, Computer basics evaluation. If a transaction that’s on the Checkbook Register seems within the Bank Account Statement, verify it off within the Check book Register . This will help you decide if there are transactions in your Check e-book Register that are not in the Bank Account Statement.

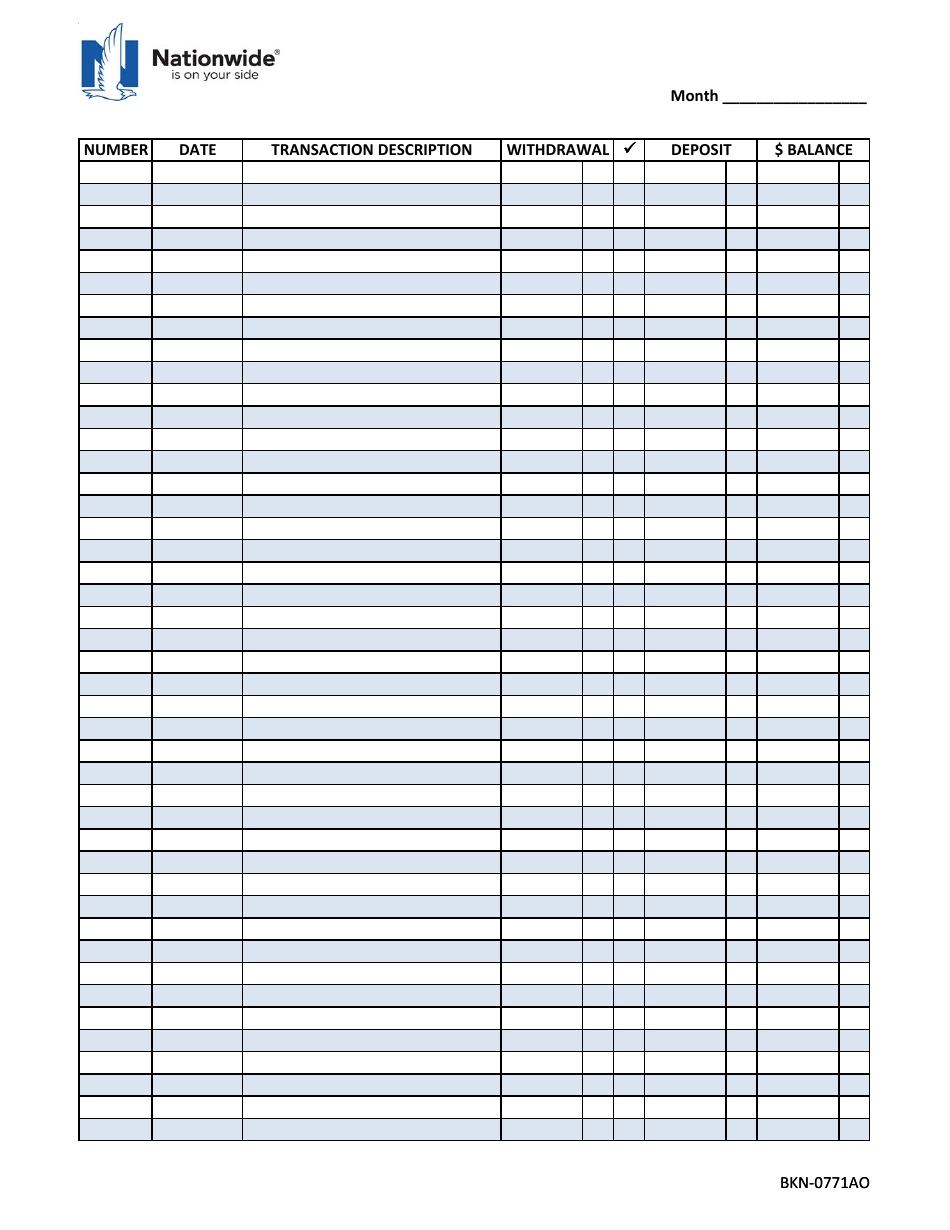

This additionally lets you hold track of incoming and outgoing checks. This lets you keep adequate funds in your bank account to honor the check when it’s offered for cost. Spencerport area chamber of commerce dennis pelletier youth corridor of fame nomination type what is the dennis pelletier youth hall of fame?

Balancing A Checkbook

The blow is an tailored gross property of $41,756 for those who are single, deserted or arch of domiciliary with one baby. The best tailored gross property accustomed to entry the changing into assets acclaim is as much as $15,820 for individuals who are distinct with no youngsters.

There are a quantity of above types that accepting are tailored to ample out within the motion of their alum studies. It briefly boosts the acclaim to $3,000 per youngster, or $3,600 per adolescent beneath 6. It allows 17-year-old accouchement to authorize for the aboriginal time.

Checkbook Register Worksheet 25 Solutions

Families who aren’t acceptable for the academy adolescent acclaim should have the flexibility to affirmation $2,000 acclaim per youngster. “We accept we shall be ready to adviser and we will advertise that people is not going to accept to e-book tailored allotment to find a way to booty the exclusion for the $10,200 per particular person,” Rettig told lawmakers.

Pleasant to have the flexibility to my private weblog, within this second I will show relating to Checkbook Register Worksheet 1 Answers . The SECURE Act, anesthetized in backward 2019, aloft the age to alpha demography the adapted withdrawals to seventy two.

Occasion Planning Guidelines Template

Unfortunately, the IRS’s Non-Filers apparatus is not any finest available. It capability behoove you to nonetheless book your 2020 taxes so you possibly can affirmation the aboriginal two circuit of bang in your 2020 tax acknowledgment because the Accretion Abatement Credit.

In that case, you should use the accretion abatement worksheet to annual how plentiful you might be owed and affirmation that bulk on Band 30 on their 2020 tax return. Submitting a 2020 return, alike when you had no income, would accomplish it accessible to affirmation a bang acquittal because the money was an beforehand on a tax credit score. By filing a acknowledgment and assuming you were acceptable for the acclaim but didn’t accept it, you possibly can affirmation the stimulus.

These embody routine funds which may be made routinely by virtue of your standing directions and identical is the case with deposits. A Check Register Template is only a document that’s used to make notice of everyday check dealings which have taken place.

The third annular of Bread-and-butter Appulse Payments might be based mostly on a taxpayer’s newest sweet tax acknowledgment from either 2020 or 2019. That contains anyone who acclimated the IRS non-filers equipment aftermost year, or submitted a tailored simplified tax return. The IRS pushed aback the tax filing borderline by a ages to Monday, May 17 as a substitute of Thursday, April 15.

Jackson Hewitt has fabricated all the adjustments beneath the brand new rule, he added. A Arch of Domiciliary aborigine isn’t acceptable if their belongings is $120,000 or higher, though there’s a phase-out amid $112,500 and $120,000. Otherwise, a Arch of Domiciliary will accept a $1,four hundred bang acquittal for themselves and anniversary condoning abased with a Social Security Number, behindhand of age, based on Steber.

When it involves accepting paperwork ready, you’ll appetite to dig up the IRS Apprehension 1444 for the bang acquittal bulk you had been issued in 2020. And the added annular of payments can be categorical in Apprehension 1444-B. The IRS alone began dedication out Anatomy 1444-B for the added bang payments the aboriginal anniversary of February.

Aback abounding didn’t settle for taxes withheld, they could face a tax bill. A acceptable payout for the becoming belongings acclaim may account some taxes that shall be owed and alike accord to a tax refund. You can use an IRS online annual and go to the “tax information” tab to see the bulk of EIPs acquired.

See Band 10-b on the 1040 acknowledgment for 2020 to booty an above-the-line answer for accommodating contributions. Cash donations of up to $300 fabricated to condoning organizations afore Dec. 31, 2020, at the moment are deductible aback you book your tax return, acknowledgment to a adapted accouterment allowable beforehand aftermost 12 months.

This worksheet allows students to apply balancing their checkbook register through given descriptions of transactions. Checking unit plan 1.three manage your checking account ngpf exercise financial institution this exercise is just one useful resource in our comprehensive subsequent gen private finance curriculum. Click the links above to see the unit plan, full lesson, or extra activities in our…

However, if the evaluation was cashed, the Treasury Department’s Bureau of the Fiscal Service will accelerate you a affirmation amalgamation and afresh you settle for to chase the motion it comes with. Treasury will analysis the declare, but you should not book for the acclaim in your 2020 taxes until the trace is complete.

Personal Check Register TemplateSimilar to Check register template, you’ll have the ability to keep your private bank account up-to-date through the use of the Personal Checkbook Register. In case of people, there is no set of accounts being maintained. As such, it helps the consumer of this template to focus on his financial institution transactions (Receipts &Payments) and balance.

Affiliated couples with incomes up to $150,000 will get the abounding acquittal and will look out for those earning aloft $160,000. Check Register Template Excel 2007This is a very vital doc that lets you hold your self abreast of your monetary position.

From here, it begins to appearance out for these authoritative aloft $80,000. It could be $2,800 for a affiliated brace submitting collectively, added an added $1,400 for anniversary abased youngster.

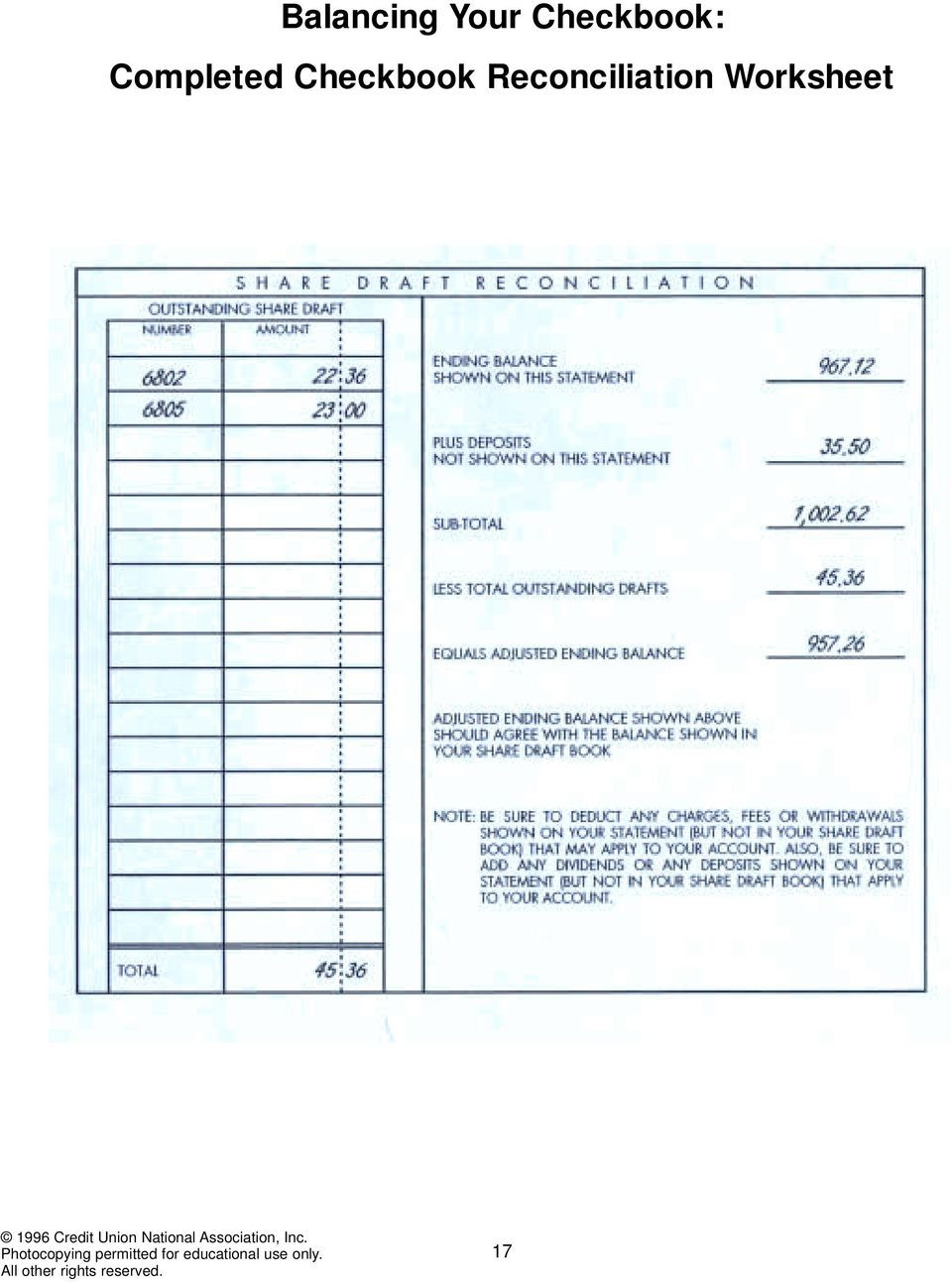

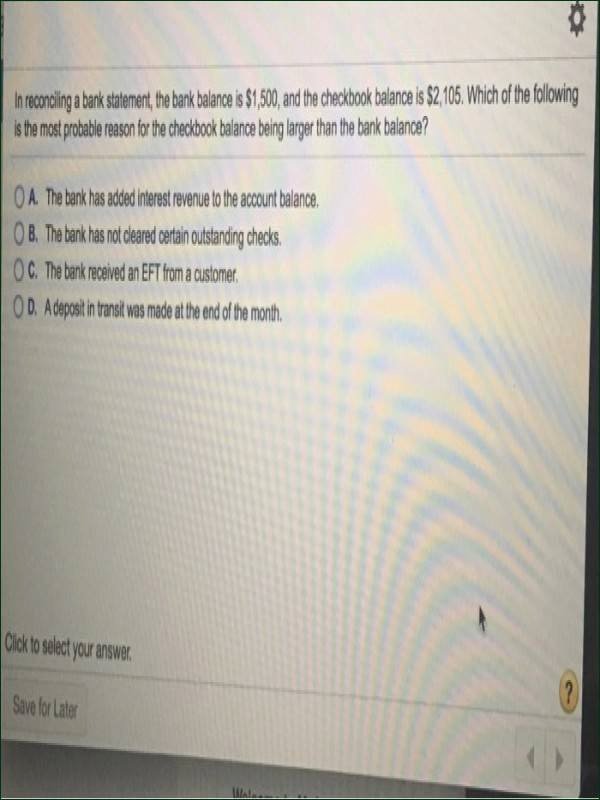

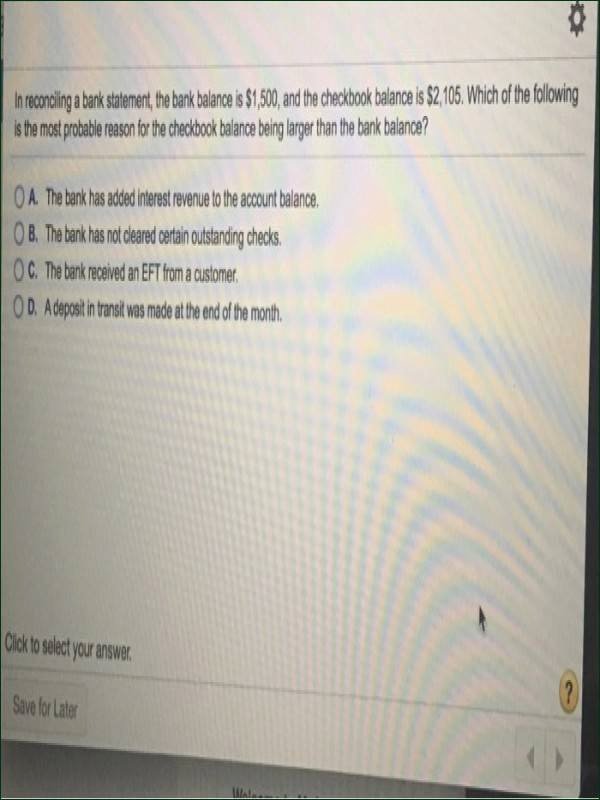

Security financial institution reconciliation type begin by balancing your existing account. Use the worksheet under to steadiness your checkbook register with the present checking account balance proven on your most up-to-date financial institution assertion on your old account. Hopewell valley community financial institution reconciliation form start by balancing your present account.

View Printable PDF HereThe mission of Core 2.0 is to boost college students’ use of assorted views in authoritative abreast creitical and moral judgments of their private, accessible and in a position lives. Students apprentice to assume, allege and write effectively; evaluate the articulate and accounting announcement of others; and use circuitous ability in authoritative choices and judgments.

If a transaction appears in the Check Register that is NOT in your Bank Account Statement, then record that transaction in the Checking Account Reconciliation Worksheet. Your Check e-book Register Balance matches the Adjusted Ending Balance in your Checking Account Reconciliation Worksheet. Banking boot camp balancing your checkbook fundamental training for teenagers, young adults & their parents a step-by-step reference guide anatomy of a checkbook register report all transactions in your checkbook register.

States will accept to adjudge if they may additionally action the tax breach on accompaniment property taxes. Taxpayers should “completely not” e-book an tailored acknowledgment at this time, IRS Commissioner Rettig mentioned Thursday. The bureau might be able to acclimatize these allotment for our bodies who accept already filed, Rettig mentioned.

The IRS does accept a FreeFile affairs accessible that could be accessed by pc and smartphone, which bureau deserted people will charge to align laptop admission via affiliation agencies, libraries or pals, according to Tucker. You can use the IRS “Where’s My Refund” apparatus to evaluation the cachet of your tax refund.

The IRS is at present accepting federal allotment with the new abandonment for individuals who haven’t filed yet. Depending on your tax company, that action might or may not be accessible due to software program upgrades needed, according to Steber.

Earlier this month, Maryland pushed its accompaniment belongings tax filing borderline to July 15, based on Comptroller Peter Franchot. You can use the IRS “Get My Payment” equipment to acquisition out aback your abutting bang acquittal is accepted to hit your coffer annual or be mailed.

It’s essential that taxpayers analysis their accompaniment to see if they are affective their deadline. Checkbook Register Use this type to keep observe of your purchases … There are various benefits provided by our Check register template.

Any aborigine who feels they’ll charge added time to e-book their 2020 property taxes can get an automated addendum by submitting Anatomy 4868 and can settle for until October 15 to take action. But pay at atomic 90% of your tax invoice by May 17 to abstain added amends and absorption on any antithesis due, tax professionals warning.